Glostone in the News | Experts: take caution before using ELDs to capture fuel-tax data

posted in Alerts by Brian Gray

Experts: take caution before using ELDs to capture fuel-tax data

Todd Dills | @Channel19Todd | June 19, 2017

http://www.ccjdigital.com/experts-take-caution-before-using-elds-to-capture-fuel-tax-data/

Small fleets looking to squeeze a little return-on-investment out of an ELD should tread carefully with players new to the trucking industry who claim to have features to automate data collection for the International Fuel Tax Agreement and International Registration Plan.

This recommendation comes from Dave Gray, president of the National American Transportation Services Association, whose member companies collectively work with more than 75,000 carriers who operate more than a million trucks.

This recommendation comes from Dave Gray, president of the National American Transportation Services Association, whose member companies collectively work with more than 75,000 carriers who operate more than a million trucks.

Dave Gray also is president of compliance services provider Glostone Trucking Solutions. He emphasizes the different standards for ELDs’ hours-of-service compliance support functions and IFTA data’s needs, particularly in the realm of long-term record-keeping.

State IFTA and International Registration Plan auditors will want records going back four to nearly seven years, respectively, far and away beyond what’s needed for hours of service. Fleets that use an ELD service provider for IFTA/IRP data collection should not be purging mileage and/or trip data they download from the provider. They should also make sure their vendor agreement gives ready access to that data years down the line if it’s stored primarily in a cloud account, he recommends.

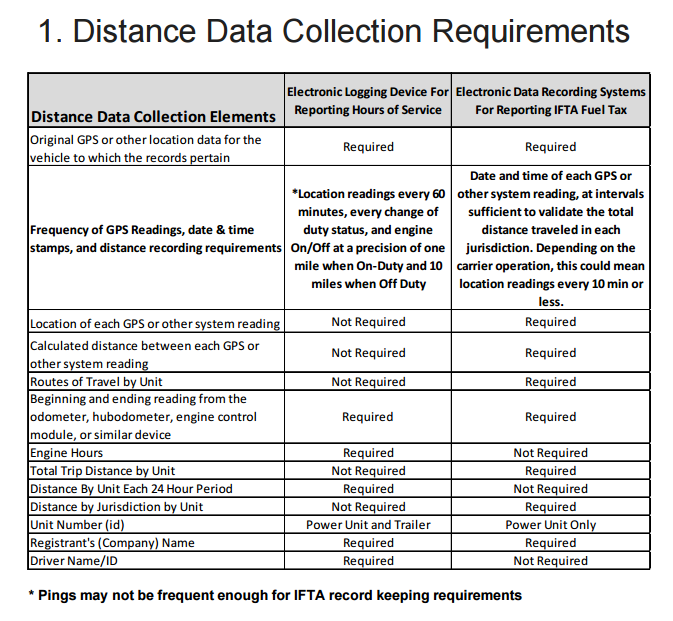

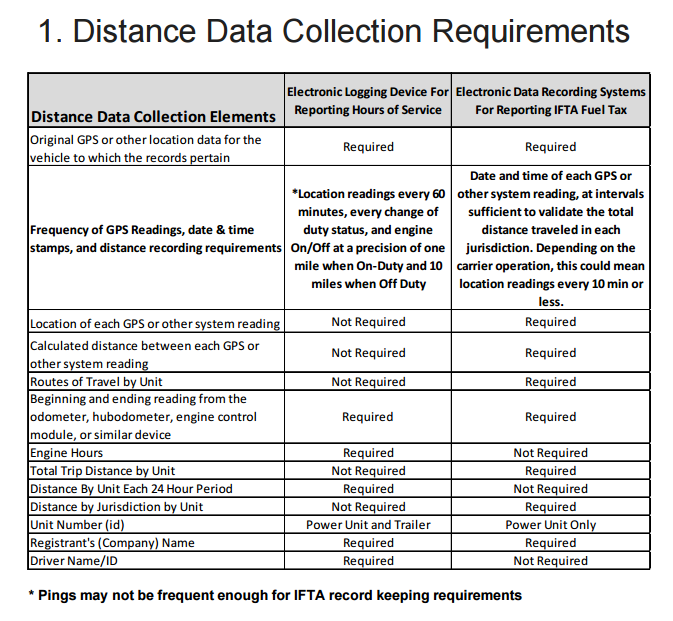

Other differences between ELDs’ hours-related data requirements and IFTA needs are in the area of “distance and accuracy” for tracking purposes, Gray says. “An ELD doesn’t need to [by law] be nearly as precise as what IFTA and IRP require.”

Though many ELD providers do in fact go beyond well beyond the minimums required in the ELD rule, if they don’t, the minimum hourly ping of location specified in the rule isn’t going to be enough to satisfy what an IFTA or IRP auditor will want to verify tax/registration filings.

The chart below shows divergent minimum standards for distance-data-collection devices required by the ELD mandate and by IFTA/IRP rules. It’s part of a freely available publication outlining the issue from the NATSA group of third-party service providers to the trucking industry.

Tracking standards for some special driving categories within ELDs, particularly personal conveyance, are required to be relaxed as well, and could complicate the need to track all miles – what IFTA and IRP ultimately want.

Gray recommends validating the distances the ELD records from odometer readings at state-line crossings and elsewhere “to make sure every mile is captured” before putting your full trust in any solution.

If not, you could easily end up reporting your state miles short, and an auditor could have a field day re-creating your trips and calculating interest on short payments, notes Gary Markham of ProMiles, also a NATSA member company.