Expect your IFTA fuel tax to increase in the Seven States Phasing in Fuel-Tax Increases, More increases coming

posted in Alerts by Brian Gray

Expect your IFTA fuel tax to increase in Seven States, More increases coming

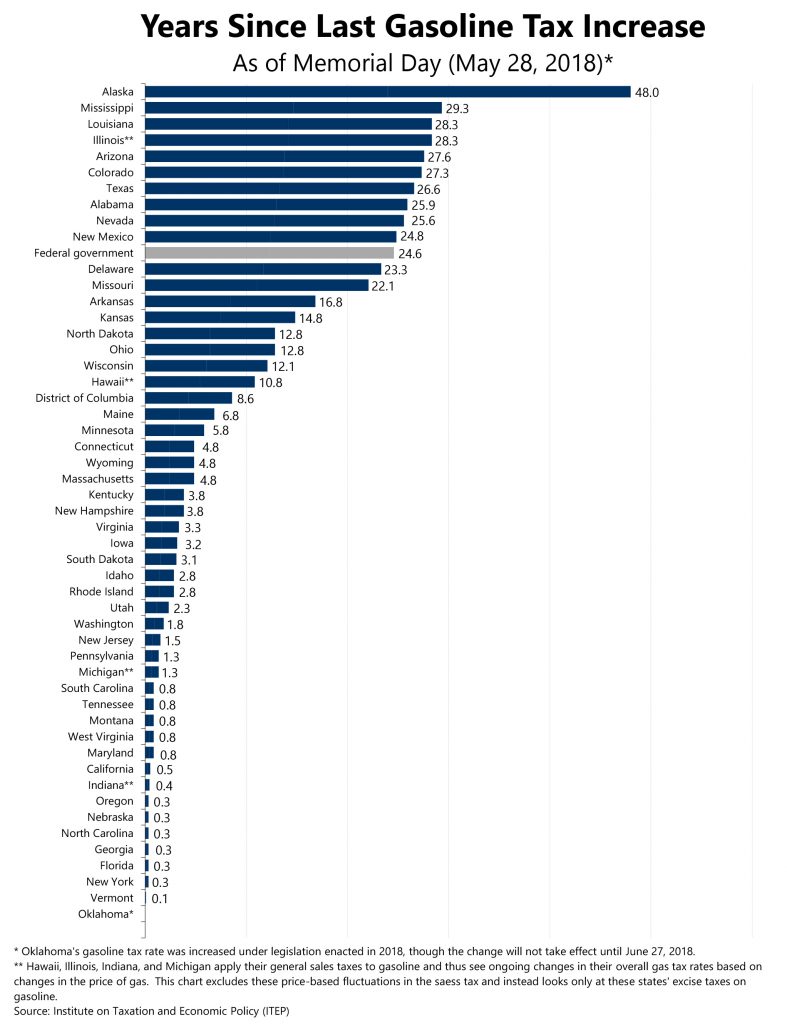

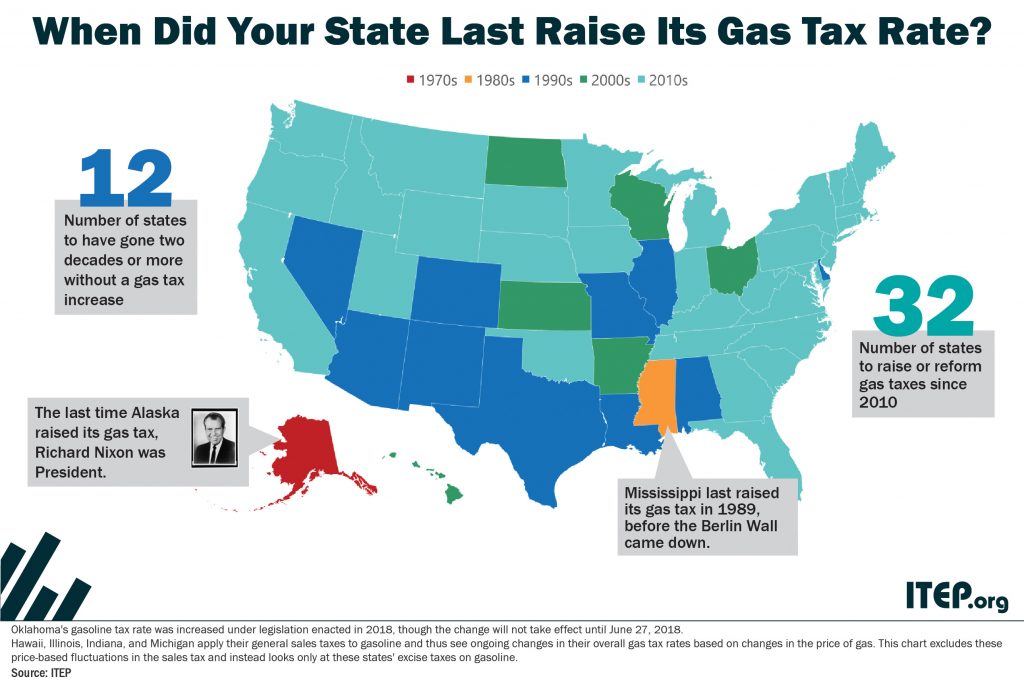

As of July 1, seven states have joined many others since 2013 that have increased fuel taxes to channel more revenue to maintaining transportation and funding construction projects.

According to ITEP, these actions are helping reverse losses in gas tax purchasing power caused by rising construction costs and improvements in vehicle fuel-efficiency. And a growing group of states has decided not just to fix past problems, but to plan for the future as well. These states are abandoning fixed-rate gas taxes (stagnant, cents-per-gallon taxes) and opting for smarter, variable-rate gas tax structures that will allow them to raise sustainable gas tax revenues for the long haul.

These seven states are: Oklahoma, South Carolina, Indiana, Maryland, Tennessee, Vermont and Iowa. This means your IFTA fuel taxes to will increase in these states.

What is IFTA Fuel tax?

Fuel and mileage taxes are a fact of life in trucking. Simply, the International Fuel Tax Agreement (IFTA) is a program to collect and distribute fuel tax revenue between states and provinces based upon where the fuel was used.

To operate trucks in excess of 26,001 lbs interstate, trip by trip fuel permits must be purchased or operators must have an International Fuel Tax Agreement (IFTA) account set up that allows the carrier to report and pay fuel taxes owed quarterly.

Setting up an IFTA account obligates the carrier to keep detailed records of travel and file quarterly fuel tax reports. In addition, a few states require a mileage tax account either in lieu of or in addition to the IFTA Fuel Tax account.

How much are the fuel tax increases in the seven states?

Oklahoma: For the first time since the last 31 years, the diesel tax by 6 cents and the gas tax will rise by 3 cents under legislation enacted earlier this year. While the revenues raised by these taxes will be dedicated to transportation, the general funds will now be directed back toward education in order to raise pay for the state’s teachers, who are the lowest paid in the nation.

South Carolina: Diesel and gas tax rates will each rise by 2 cents per gallon as part of the second stage of a six-part increase. These tax rates will eventually rise by a total of 12 cents per gallon because of legislation enacted in 2017.

Indiana: The diesel tax will rise by 1 cent and the gas tax will rise by 1.8 cents. Both taxes are now updated annually to keep pace with inflation and the rate of personal income growth in the state due to a reform enacted in 2017.

Maryland: Diesel and gas taxes will each rise by 1.5 cents per gallon because of a formula implemented in 2013 that ties the tax rate to increases in the rate of inflation and in the price of motor fuel.

Tennessee: Diesel tax will increase by 3 cents while the gas tax will rise by 1 cent. Tennessee is in the process of phasing in a 6-cent gas tax increase and 10-cent diesel tax increase enacted in 2017.

Vermont: Diesel tax rate will remain unchanged while the gas tax will rise by 0.42 cents. Vermont’s gas tax is linked to the price of gas, and an increase in gas prices led to this tax change.

Iowa: The gas tax rate will rise by 0.2 cents for fuels that are not blended with ethanol. Most fuel in the state will be unaffected by this change as ethanol-blended fuel is more common in Iowa.

Fuel and Mileage Tax Reporting

When dealing with taxation authorities, accuracy and record keeping is essential. Glostone Trucking Solutions collects, double checks, interprets, files and stores both paper and e-trip data to ensure every client pays the right amount, to the right place, on time, every time.

Our technology, expertise and workflow process allows us to work with GPS data and fuel down loads, paper trip records and paper fuel receipts, or a combination of both. We guarantee our work!